Data sourced from Education Data Initiative, last updated Oct. 15.

Isaac Fick|Marlin Chronicle

The Biden administration’s student debt relief plan has been paused again. A federal judge in Missouri issued a ruling that suspends the execution of the measure focused on forgiving up to $20,000 in student loans for millions of borrowers.

The decision stands as a setback for the Administration’s efforts to relieve the financial burden on graduates. The halt marks the latest story in a legal dispute over the plan, which has faced multiple challenges since it was first announced.

For borrowers, the future is left uncertain. Director of Financial Aid at Virginia Wesleyan University Beth Koroleski spoke on this situation.

“It’s unfortunate that this has taken so long and borrowers were promised relief, and it just has never crossed the finish line. So I think forbearance is until April, so they’ll continue to be in forbearance until a decision is made. And with the new administration, I think we may see a completely different plan. I think there will be a plan, but it will probably be shifting to a new version,” Koroleski said.

The ruling from the U.S. District Judge Henry Autrey of Missouri came after a group of conservative states argued that the debt relief program pushes past the administration’s legal authority. In his verdict, Judge Autrey stood with the plaintiffs, stating that the program could have infringed on the Constitution’s separation of powers and the powers granted to the executive branch.

For Virginia Wesleyan students, the school offers many grants, scholarships and loan repayment options.

“We offer so many institutional scholarships and grants, along with the state grant that from what I’ve seen in my experience working in financial aid, I think our students have some of the lower borrowing historically than the schools I’ve worked at,” Koroleski said.

The student debt relief plan, which was anticipated to scrub up to $20,000 in student loan debt for borrowers grossing under $125,000 annually, had been promised as one of the most noteworthy steps toward mitigating the nation’s growing student loan crisis.

“So unfortunately, again, families are kind of in the same place that financial aid administrators are in, where we are just waiting for the Department of Education and the government to make decisions on what’s going to happen. Fortunately, there has always been some type of income based repayment plan available to borrowers. This new plan promised more relief as far as forgiveness goes. However, I think we can have a positive outlook that there will be some sort of income based plan that will allow borrowers to pay based off their income,” Koroleski said.

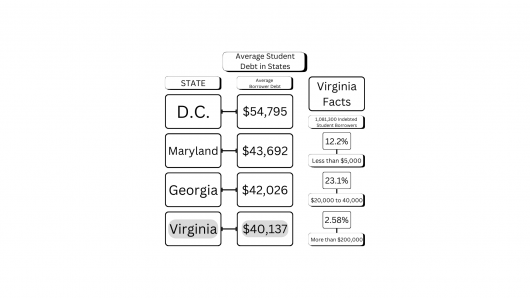

Within specific states of the U.S., borrowers are affected differently. The area most heavily affected is Washington D.C., with the average student loan debt per borrower sitting at $54,145.52. The states in second and third are Maryland and Georgia respectively, both standing between $41-44,000 per borrower.

Fourth, and most relevant to students at Virginia Wesleyan, is the state of Virginia. An average borrower in the Commonwealth can expect to owe $40,210.27 in student loan debt.

For most students, the process of paying student loans may not be clear cut. To explain it for students, Korolseki clarified the process at Virginia Wesleyan.

“We’re always available to re-evaluate student situations. So for current students, […] your loans are in deferment, in school deferment, so you’re not required to start paying them back, and you’ll still get your six month grace period before you do have to start paying them back. So when the time comes to exit, loan counseling is required of any borrower. So you will go through that with the Department of Education,” Koroleski said.

Koroleski also spoke about Virginia Wesleyan’s staff and the processes within the school for borrowers post-graduation.

“But we’re also here to help walk you through the process, let you look at your options, connect you with your loan servicer, and throughout your program here, if at any points, the loans become too much or you just can’t get maybe a parent loan that you had gotten in the past, we’re always willing to look at those situations and help institutionally so that you can complete your degree,” Koroleski said.

While the future may be uncertain for loan borrowers across the country, a few things are concrete. This plan is subject to change, there are options and Virginia Wesleyan is here to help.

Infographic link:

https://educationdata.org/student-loan-debt-by-state#:~:text=District%20of%20Columb ia%20residents%20have,17.2%25%20of%20residents%20in%20debt.

Mars Johnson|Marlin Chronicle

By Crosson Miller