By Vanessa Smith

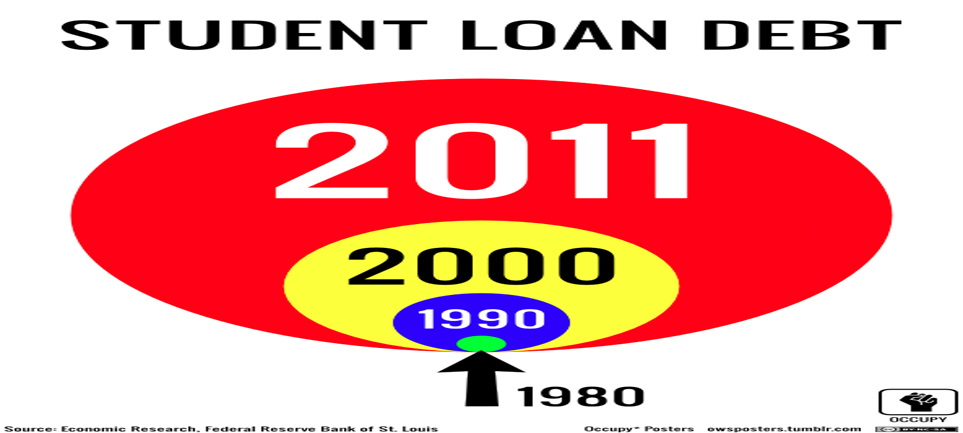

College student debt has long passed the amount of credit card debt in America and is the most common form of increasing debt among 18- to 24-year-olds. Student loan debt rose at an average of 6% per year from 2008 to 2012. In 2011, student debt averaged $26,600. In 2012, the average college graduate was $29, 400 in debt. The graduating class of 2013 averaged $35,200 in debt. College students across America can expect these numbers to continue increasing.

Federal regulations require that students who have received a Teacher Education Assistance for College and Higher Education Grant complete an exit counseling session. This exit counseling session provides information about the terms and conditions of a TEACH Grant service agreement, as well as the rights and responsibilities that apply.

During the last week of October, Elizabeth Payne sent out an email regarding all students that had confirmed they were not returning to Virginia Wesleyan College for the Spring 2015 semester. Payne said that about 50 students were to go through exit counseling, whether they were graduating, transferring, or taking next semester off.

At the meeting, Payne gave students their individual loan statements and helped guide students down payment paths that might work best for them. Students learned about different payment plan options, but Payne reminded students that the longer the payments were drawn out, the more money they would pay in the end.

Payne also made it clear loan repayment is a firm requirement. When going through exit counseling, one has to fill out three references so students who don’t make their payments on time could be tracked down, and paychecks may be garnished.

Some of the payment options Payne presented were the Standard Repayment Plan, which includes loans with a fixed amount of at least $50 per month for up to 10 years; Graduated Repayment Plan, which includes loans that have payments lower at first and then increase, usually every 10 years; the Extended Repayment Plan loans can be either fixed or graduated for up to 25 years. Income-Based Repayment Plan, Pay As You Earn Repayment Plan, Income-Contingent Repayment Plan, and Income-Sensitive Repayment Plan are loans in which loan payments change as an individual’s income changes.

The calculations that were done for the students before the meeting and given to them in their folders consisted of the amounts of money and time it would take students to pay off their loans if they used the Standard Repayment Plan. Once a student enters graduate school, the loan payments options vary.

Some students feel that colleges do not offer enough of these loan options when creating financial aid packages.

“I feel like that they don’t offer us a fair variety of options, senior Jennifer Patton said. “They really stress the one repayment plan option that carries a lot of fees. I also feel like there needs to be better communication between the business office and financial aid office because I’ve been told to take out loans that end up being more than what I actually owe to the school.

Most students use the Standard Repayment Plan. This plan has a fixed amount for each month which is a minimum of $50 and students are only allowed up to 10 years to repay their entire loan. The Graduated Repayment Plan is similar, but the payments start low and increase every two years, allowing students 10 years to pay off their entire loan.

After leaving the exit counseling session held by Payne, students were made to complete exit counseling online at studentloans.gov. Until doing so, a hold was placed on their Virginia Wesleyan accounts.

The online portion of the exit counseling process consisted of statistics on loans for students and questions for students to answer to make sure they read and understood the information presented. The exit counseling also notifies students of the times it is important for them to contact their loan servicer. Students must contact their federal loan servicer about anything that impacts their student loan repayment obligations along with address changes and leaving school.

“Financial aid services in colleges leave many students with large debts as they leave school, senior Sheryl Ferrell said. “ It terrifies me knowing that, even with good grades and scholarships, I’ll be paying back more than $70,000 after graduation. In today’s society, you need a degree for most jobs, but you’re left with this giant debt on your shoulders.. It’ll take years to pay it all off; how are we supposed to ever get ahead

Down the road, student loans can also be forgiven. This means that at some point during their payments, their loan servicer can forgive their loans and the student or graduate will no longer have any payments to make. Some of the varying careers offer loan forgiveness through performing volunteer work, serving in the military, teaching or practicing medicine in certain types of communities, and serving in public interest or non-profit positions.

College students can expect student loan debt to increase again for the graduating class of 2014. College students can only hope that the price of college tuition goes down or that their loans become forgiven at some point.